Dedicated Garage Department

Specializing In Repair and Service Operations and Non-Franchised Dealers

Become a producer, access our markets and grow your agency.

Quick Links

The commercial garage insurance market can be a mystery.

Our Underwriting and Support staff have years of knowledge and expertise to deliver the correct product and resolve conundrums.

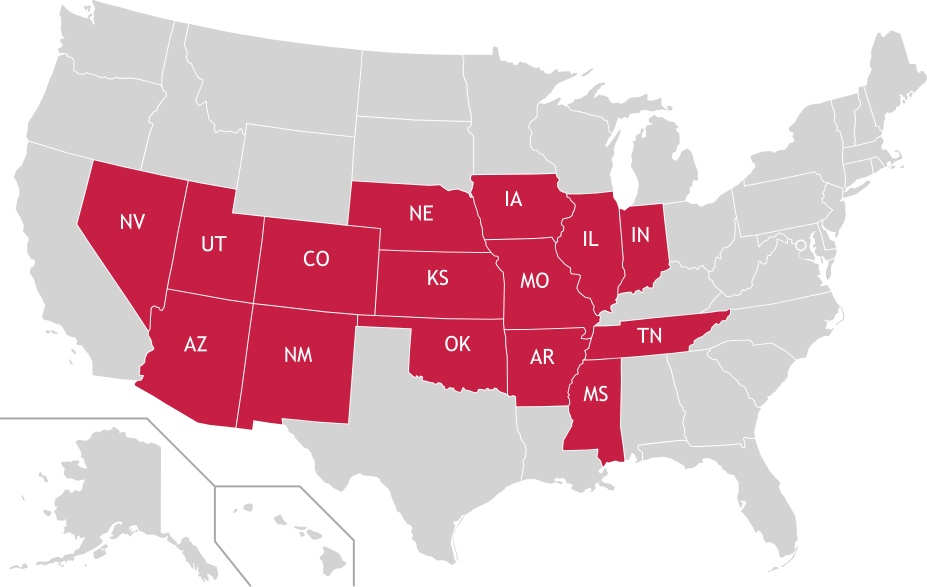

Multiple A rated markets provides us the flexibility to write your business in our contracted states, highlighted on the map, or nationwide via a referral.

What is a Garage Policy?

Think of it as a combination of an Auto and General Liability cover for owned and non-owned auto plus premises and products and completed operations.

Liability (Garage and Scheduled Autos)

Up to $1,000,000 per occurrence

Up to $3,000,000 per aggregate

Broadened

Broad Form Products

Broad Coverage Endorsement

Dealer E&O

GarageKeepers

Up to $500,000 location limit

Phyiscal Damage and Open Lot

Up to $500,000 location limit

Medical Payments

Up to $5,000 location limit

UM/UIM

Up to $1,000,000 limit

In Transit/On Hook

Coverage on tows

Ancillary

Property, Crime, Inland Marine and other related coverages

Repair and Service Operations

We have a pretty big appetite, but are always willing to work with you to find the right coverage for all of your risks.

Non-Franchised Dealers

Whatever the size of the community in which you live, there are several garage operation types. Each one is a premium income opportunity for you.

Frequently Asked Questions

One lawsuit could spell the end of the business your client has worked hard to build and operate. Our Underwriting and Support staff has the knowledge and expertise to deliver the correct products.

In general, a dealer tag is issued to an account by the state which allows individuals – owners, employees, family & customers – to legally drive unregistered vehicles.

DOL provides Physical Damage coverage for vehicles owned by the dealership. Coverage is based upon the dealers’ total on hand inventory and generally has a coinsurance requirement of 100% for Specified Cause or Comprehensive and Collision. Location, lot protection, weather exposure and prior loss experience are key factors in determining the premium charge.

Garagekeepers provides legal liability coverage for damage to a customer’s vehicle while the Garage policy covers Liability and Physical Damage for the accounts operation.